Get Funded with

Fewer Docs, More Flexibility

Ideal for self-employed Australians and business owners, our Low Doc Loans provide flexible lending with less paperwork—expertly guided by Diamond Lending, a trusted financial brokerage firm that connects you with the right lenders to match your unique needs.

Simplified Low-Doc Loans for Easy Access to Finance.

Diamond Lending specialises in low documentation loans that cater to self-employed professionals seeking flexible, straightforward finance options by connecting you with the right lenders.

Small Business Owners

Flexible loan options designed to support your business growth with minimal paperwork and quick approvals.

Self-Employed Professionals

Tailored finance solutions for those with irregular income seeking fast, low-doc loan approvals.

Contractors

Flexible loan options tailored for contractors, offering minimal paperwork and fast, hassle-free approvals.

Getting a loan with minimal docs wasn’t possible, but now it is.

Australia’s Trusted Financial Brokerage Firm

Traditional lenders often require extensive documents that don’t fit your income style. At Diamond Lending, we connect you with lenders who understand your unique situation and offer loans with minimal documentation—making borrowing faster, simpler, and tailored to you.

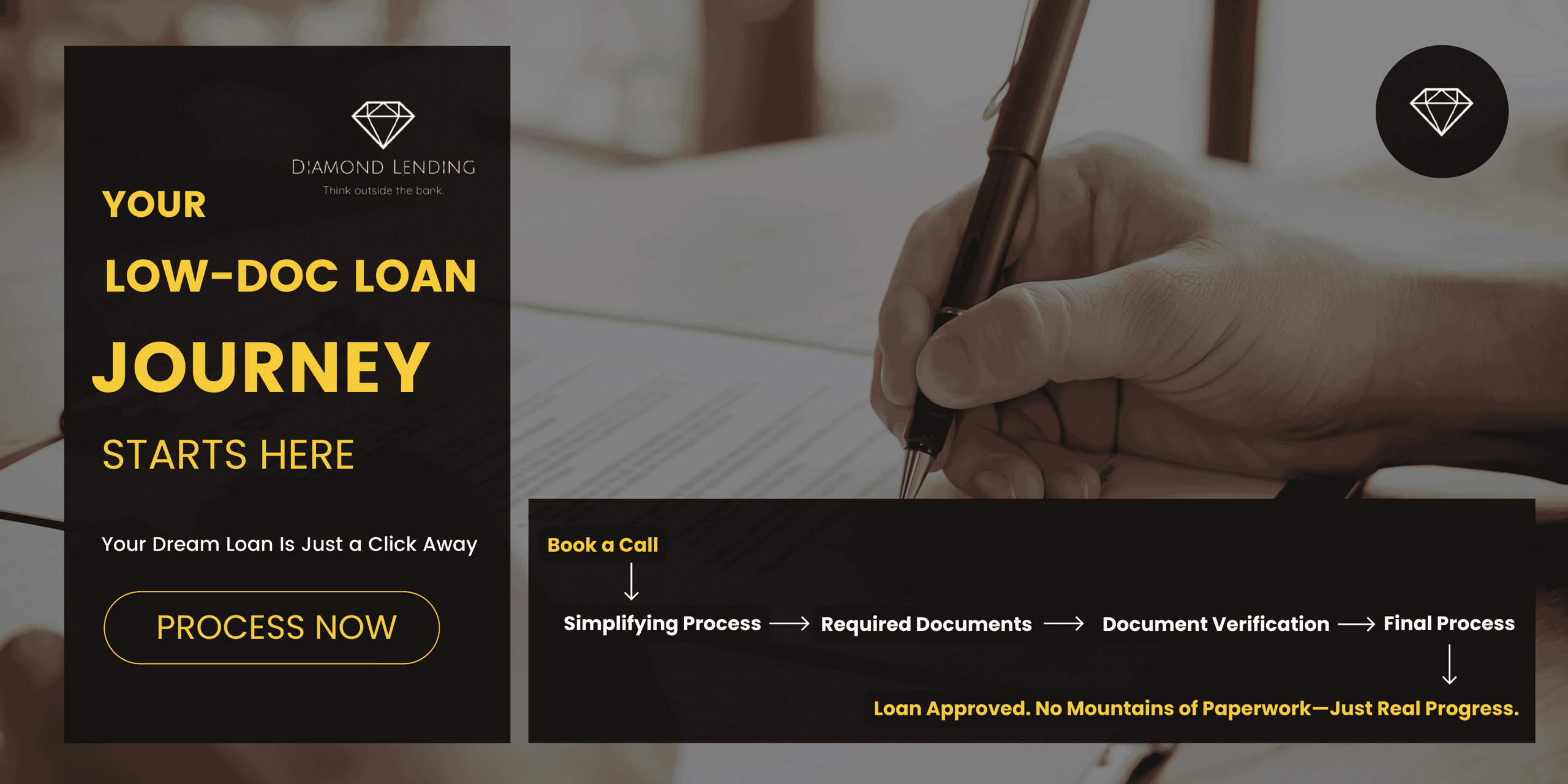

How Diamond Lending Simplifies the Low-Doc Loan Process

From the first step to settlement, Diamond Lending streamlines your low-doc loan journey with expert guidance, lender access, and zero guesswork.

Step #1

Simplifying Your Low-Doc Loan Process

📄 Bank Statements

We begin by carefully reviewing your income type, business setup, and financial goals. This helps us recommend Low-Doc Loan options tailored to your unique situation, empowering you to borrow with confidence.

📄 Access to Australia’s Leading Low-Doc Lenders

As your trusted brokerage firm, Diamond Lending connects you with lenders specialising in Low-Doc Loans. We compare rates, fees, and terms to find flexible options that suit your lifestyle and financial needs.

📄 Expert Assistance with Application & Documentation

Our experienced team supports you throughout the process—from gathering essential documents to submitting your application—ensuring accuracy and minimising delays.

📄 Effortless Approval and Settlement Coordination

Once your application is lodged, we act as your liaison with lenders, managing communications and coordinating with all parties to ensure a smooth, stress-free settlement.

Step #2

Required Documents

📄 Bank Statements

Submit your recent 3 to 6 months of bank statements. These provide lenders insight into your income flow and financial habits.

📄 Evidence of Deposit

Show proof of your deposit funds such as savings or a gift letter if someone else is contributing.

📄 Proof of Residency Status

Provide evidence of your Australian citizenship or permanent residency to confirm eligibility for Low-Doc Loans.

Step #3

Pre-requisites

📄 A stable source of income with consistent history

Even with Low-Doc Loans, lenders require steady earnings and a reliable work background.

📄 Sufficient deposit saved, usually 5% to 20% of the property value

A strong deposit improves your approval chances and interest rates.

📄 A good credit history without recent defaults or bankruptcies

Lenders look for a clean credit record to assess your financial responsibility.

📄 Australian citizenship or permanent residency status

You must provide proof of your legal right to live and borrow in Australia.

📄 Ability to comfortably service the loan within lender criteria

Show that your income and expenses allow for manageable repayments without financial strain.

Popular Questions

How long does the approval process take?

Yes, many lenders offer low-doc loans for self-employed borrowers, and we help you connect with them.

Can I get a home loan with a small deposit?

Generally, approval can take between 1-5 business days depending on lender policies and documentation completeness.

Is a deposit always required for low doc loans?

Not always, but a deposit may improve your loan terms and approval chances.

Can I refinance an existing loan using a low doc loan?

Yes, refinancing options are available, and we can assist in finding competitive solutions.

Do Low-Doc Loans have higher interest rates?

They may carry slightly higher interest rates compared to full-documentation loans due to the perceived risk. However, with the right lender and a strong application, Diamond Lending can help negotiate competitive terms.

Have more questions?

We’ll guide you with honest advice and low-doc loan options that fit your needs and future plans.