Access Flexible Loans Designed for Credit Impaired Borrowers

From credit assessment to loan settlement, Diamond Lending simplifies your finance journey with tailored solutions designed for credit impaired borrowers.

Tailored Credit-Impaired Loan Solutions to Help You Rebuild and Move Forward

Whether you have past credit issues, defaults, or bankruptcy, Diamond Lending, a trusted financial brokerage firm, connects you with lenders who understand your situation and offer flexible loan options designed to help you regain financial confidence.

Individuals with Past Credit Defaults

Loans designed to support those with previous defaults, offering a pathway to rebuild credit and secure finance.

Self-Employed or Contractors with Credit Challenges

Specialist lenders who understand non-traditional income and credit histories, providing loan options that fit your unique profile.

Applicants Recovering from Bankruptcy

Flexible solutions tailored to help you re-enter the property market or refinance despite past bankruptcies.

Credit challenges don’t have to hold you back, Diamond Lending makes approval possible.

Australia’s Trusted Financial Brokerage Firm

We help you overcome credit challenges by connecting you with lenders who offer flexible loan options across Australia. Whether rebuilding your credit, refinancing, or purchasing a home, our tailored solutions are designed to support your financial goals.

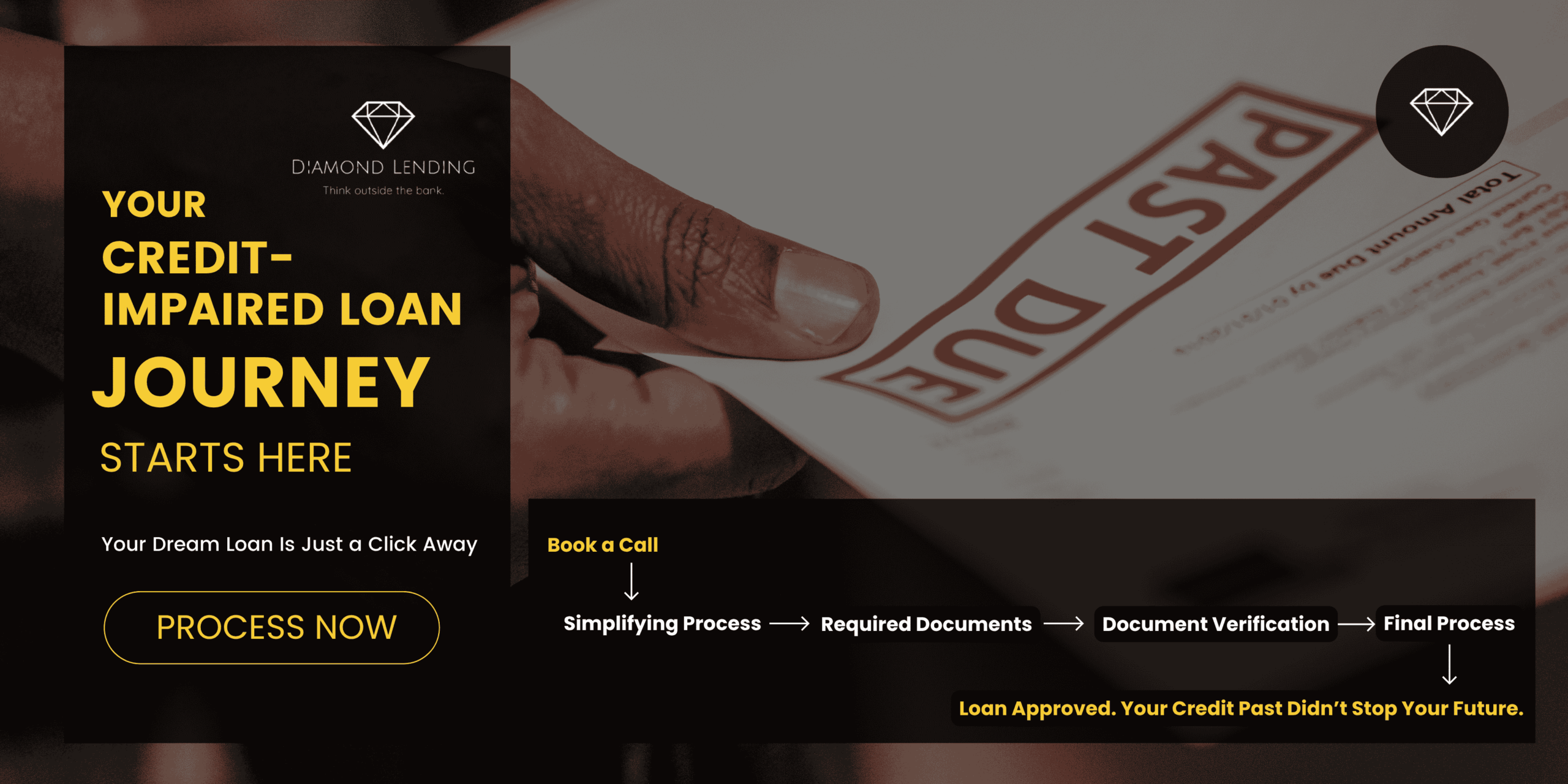

How Diamond Lending Simplifies the Credit-Impaired Loan Process

From the very first step to final settlement, Diamond Lending powers your credit-impaired loan journey with expert guidance, exclusive lender access, and solutions designed to rebuild your financial future—no guesswork, just results.

Step #1

Simplifying Your Credit-Impaired Loan Process

💸 Personalised Credit Assessment

We evaluate your credit history and current financial situation to find lenders willing to work with your circumstances.

💸 Access to Specialist Lenders

Diamond Lending partners with lenders who specialise in credit impaired loans, offering options that traditional lenders may not provide.

💸 Assistance with Documentation & Application

Our team guides you through the application process, helping you prepare explanations and supporting documents to strengthen your case.

💸 Negotiating Terms That Suit You

We work to negotiate terms that balance your needs with lender requirements, aiming for manageable repayments and reasonable interest rates.

💸 Ongoing Support & Credit Rebuilding Guidance

Beyond settlement, we offer advice to help you improve your credit profile for better finance opportunities in the future.

Step #2

Required Documents

💸 Credit History Disclosure

Provide details of past credit issues, defaults, or bankruptcies to help lenders understand your situation fully.

💸 Proof of Income

Submit recent payslips, tax returns, or financial statements to verify your ability to meet repayments.

💸 Explanation Letter

A written statement explaining the reasons behind your credit impairment and demonstrating steps taken to improve your financial health.

Step #3

Pre-requisites

💸 Demonstrated Ability to Service the Loan

Lenders look for evidence that you can comfortably meet repayments despite past credit issues.

💸 Proof of Stable Income

Consistent income is crucial to reassure lenders of your repayment capacity.

💸 Good Conduct Since Credit Issue

Showing responsible financial behaviour since your credit impairment supports your loan application.

💸 Sufficient Deposit or Equity

A solid deposit or equity contribution improves your chances of approval.

💸 Clear Purpose for the Loan

Lenders prefer borrowers with a well-defined plan for the loan, whether buying, refinancing, or consolidating debt.

Popular Questions

Can I get a home loan if I have a bad credit history?

Yes, Diamond Lending works with specialist lenders who consider credit impaired applicants, helping you find suitable loan options.

How much deposit do I need for a credit impaired loan?

Deposit requirements vary but typically range from 10% to 30%, depending on the lender and your credit situation.

Will my past bankruptcy prevent me from getting a loan?

Not necessarily. Many lenders offer loans for those recovering from bankruptcy, provided you demonstrate improved financial management.

How long does the credit impaired loan process take?

It varies, but with expert guidance from Diamond Lending, we aim to make the process as smooth and timely as possible.

Can I rebuild my credit after taking a credit impaired loan?

Yes, responsibly managing your loan repayments can help improve your credit score over time.

Have more questions?

We’ll guide you with honest advice and credit impaired loan options that fit your needs and future plans.