Build Your Dream Home from the

Ground Up

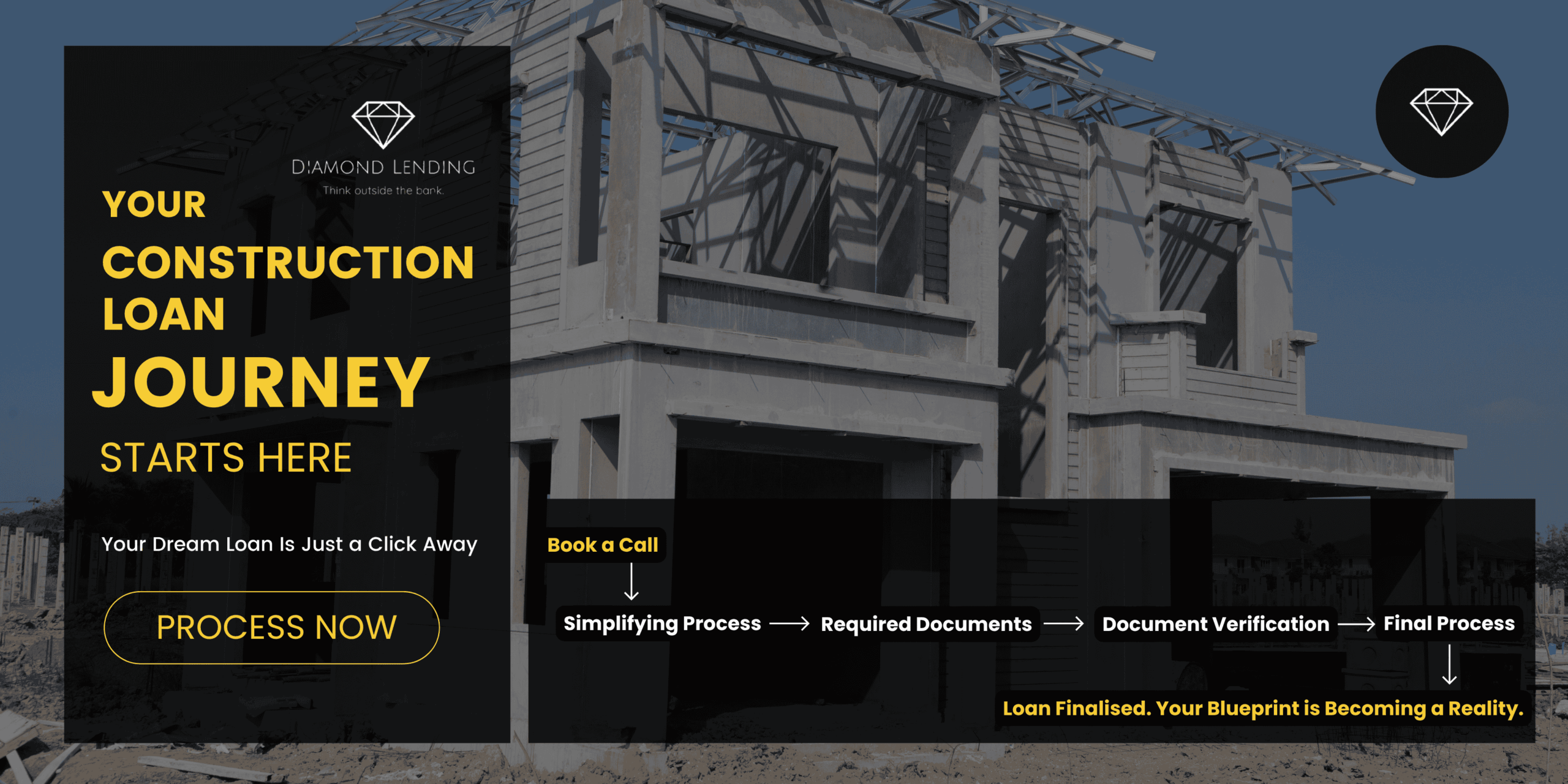

From the first step to settlement, Diamond Lending streamlines your home loan journey with expert guidance, lender access, and zero guesswork.

Flexible construction loans to build your future, stage by stage.

Whether you’re building your dream home, investing in a new property, or starting from scratch, Diamond Lending connects you with lenders who align with your construction timeline, budget, and long-term goals.

Investment Property Builds

Build-to-invest solutions with flexible interest-only repayment options and financing structures that support future rental income.

Owner-Builders

Tailored construction loans designed for those managing their own home build, with lender support for staged payments and clear documentation guidance.

Knockdown & Rebuild Projects

Loan options made for starting fresh on the same land — ideal for upgrading your home without changing your address.

Constructing a home is an exciting journey when you have the right loan by your side.

Australia’s Trusted Financial Brokerage Firm

At Diamond Lending, we simplify your construction loan process by connecting you with lenders who understand staged payments, builder requirements, and your long-term goals.

How Diamond Lending Simplifies your Construction Loan Process

Whether you’re building on a vacant block or undertaking a major renovation, we help you secure a flexible loan structure that aligns with your timeline and budget.

Step #1

Simplifying Your Construction Loan Process

🏗️ Tailored Financial Assessment for Construction Planning

We begin by assessing your financial situation, construction plans, and property goals. This helps us recommend a construction loan with the right structure—ensuring you borrow efficiently at every stage of the build.

🏗️ Access to Australia’s Leading Construction Loan Lenders

As your dedicated brokerage, Diamond Lending compares offers from a wide network of reputable lenders. We evaluate rates, stage payment terms, and loan features to find the most suitable option for your building journey.

🏗️ Support with Building Contracts & Valuations

Construction loans require additional documentation, such as builder quotes and fixed-price contracts. Our team works with you to ensure all documents meet lender requirements, reducing delays or rework.

🏗️ Seamless Progress Payment & Settlement Coordination

We help manage drawdowns at each stage of construction—from slab to handover—liaising with lenders and builders to release funds smoothly and keep your project moving on schedule.

Step #2

Required Documents

🏗️ Builder’s Fixed-Price Contract

A signed agreement that outlines total costs, timelines, and construction stages—essential for lenders to approve progress payments.

🏗️ Council-Approved Building Plans & Permits

Your house plans and local council approvals ensure the build meets legal standards and support lender valuation.

🏗️ Evidence of Deposit & Bank Statements

Show your deposit amount through savings or equity, along with 3–6 months of bank statements to assess financial readiness.

🏗️ Proof of Land Ownership or Contract of Sale

If you already own the land, provide your title deed. If purchasing, submit the land contract to establish security for the loan.

🏗️ Builder’s Insurance & Licences

Include the builder’s construction insurance and licence details—lenders require this to confirm the builder meets regulatory standards.

Step #3

Pre-requisites

🏗️ Clear construction plan and fixed-price building contract

A detailed agreement with your builder outlining costs, timelines, and materials is crucial for lender approval.

🏗️ A good credit history and reliable income source

Lenders expect steady income and a strong repayment profile to approve stage-based disbursements.

🏗️ Deposit of at least 5% to 20% depending on lender

A larger deposit reduces risk and may help secure better interest rates or faster approvals.

🏗️ Valuation of land and proposed dwelling

A lender will order a valuation of the vacant land and completed project to confirm the loan-to-value ratio (LVR) before approving funds.

🏗️ Australian citizenship or permanent residency status

Proof of eligibility to borrow within Australia is required for all construction loans.

Popular Questions

What is a construction loan and how does it work?

A construction loan is a short-term, progressive-draw loan that releases funds in stages as your home is built. You typically pay interest only on the amount drawn during construction, helping you manage cash flow until the build is complete.

How much deposit do I need for a construction loan?

Most lenders require a deposit of 5% to 20% of the total land and construction cost. A higher deposit can help improve your loan terms and approval chances.

Do I need to own land before applying for a construction loan?

Not necessarily. You can apply for a construction loan that includes both land purchase and construction costs, provided you have a fixed-price building contract and council-approved plans.

Can I make changes to the build after the loan is approved?

Yes, but major changes may require lender reassessment and revaluation. Variations to cost, structure, or builder terms can delay fund releases, so it’s best to finalise everything before applying.

Why choose Diamond Lending for a construction loan?

As a trusted financial brokerage firm, Diamond Lending simplifies every step — from selecting the right lender to coordinating with your builder and ensuring staged funds are released without delays. We manage the paperwork, so you can focus on your dream home.

Have more questions?

We’ll guide you with honest advice and construction loan options that fit your needs and future plans.